When it is required to update the multiple tax values based on Sales organization and its distribution channel for a particular country through Transaction Technology, a Data Extractor Excel Add-In file is implemented to extract the maximum count so that the Dynamic Skips can be implemented accordingly in the transaction file.

Follow the steps mentioned below to extract the required data.

1.Download and Open the Excel Add-In file from here or refer to the Cloud Sample 471 'How to find Tax Jurisdiction'. 2.Click on "Download Tax Data".

Note: Please make sure that no changes are made to the Excel Add-In file

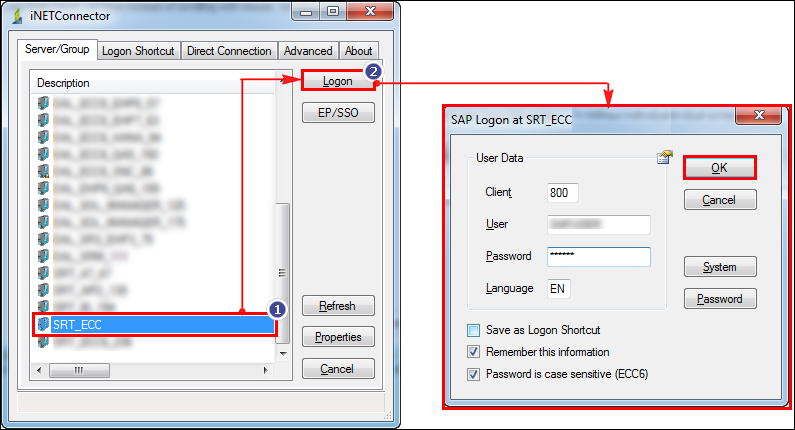

3.Select the SAP Server/Group, provide valid credentials and Click on Logon.

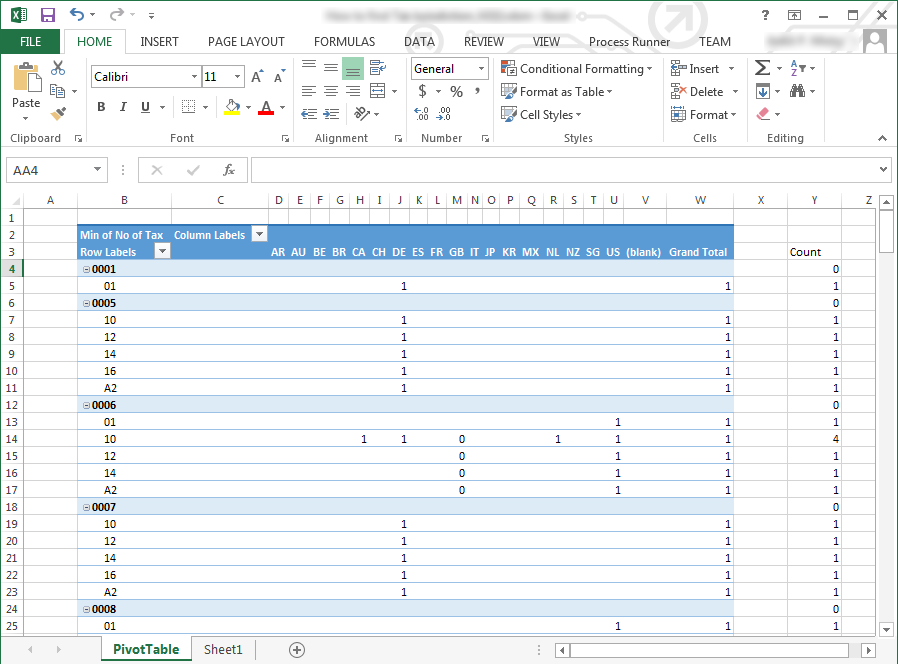

4.Click on 'Create Pivot Table' to generate a Pivot table based on the extracted data of your SAP System as shown in the image below.

This Pivot table will be generated in a new sheet as shown in the image below.

Now that the Tax Count available within Distribution Channel and Sales Organization is figured out, download and modify the MM01 Process File Cloud Sample 2171 for your environment as instructed below. Refer to How to Open/Download Cloud Samples.

1.Once the Cloud Sample 2171 is downloaded, open the process file and go to Mapper. 2.Observe the maximum value at the "Count" column in the PivotTable sheet of Excel Add-In file. 3.From the above example of downloading tax data and creating Pivot Table, we have the maximum value of column "Count" as 5, according to which the Process File (Cloud Sample 2171) is created. If the maximum value of column "Count"is more/less than 5, then refer to the below image where we are Adding/Removing fields. This is done manually. Refer to "How to manually add screen and fields in Mapper" to Add/Remove fields manually in Mapper.

Here for example: If maximum value of column "Count" is 1, then we have added a screen and fields as highlighted below.

Note: Please ensure that the Field of "Tax Classification Material (MG03STEUER-TAXKM)" in Mapper is equal to the maximum value of the "Count" column of the PivotTable sheet.

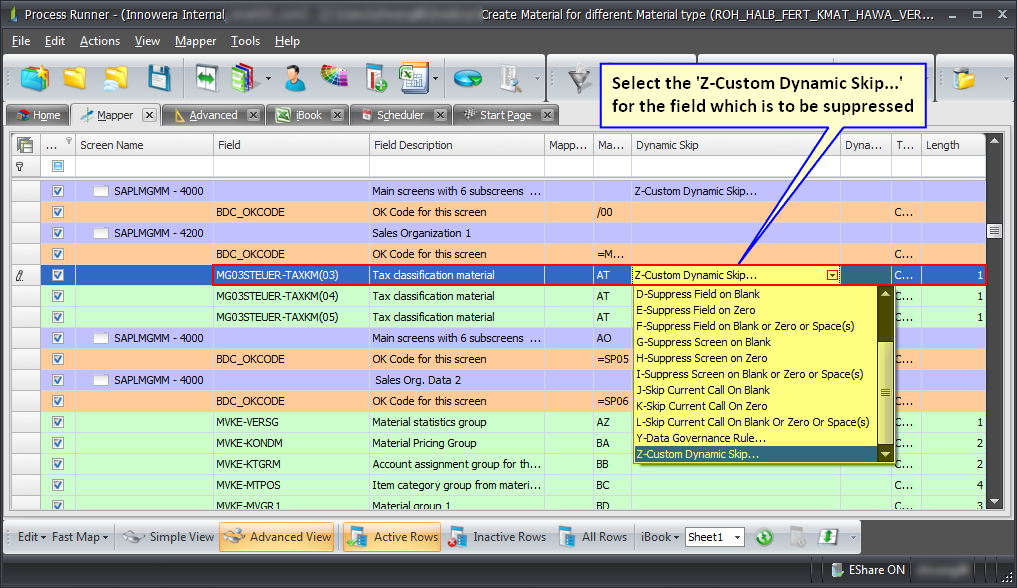

Now according to the combination of sales organization and distribution channel, field suppression is required where tax classification is not available.

As demonstrated in the above image, the total tax available for Distribution Channel '12' in Sales Organization '0005' is 1. Hence the value in the count column is 1. But in Mapper, there are 5 tax classification fields whereas only 1 tax classification field is required.

In such cases, suppression of rest of the 4 fields is required which is done using "Z-Custom Dynamic Skip". Follow the steps mentioned below to suppress the fields which are not required.

a.To suppress the fields, Go to Mapper in Cloud Sample 2171. b.Click and Select 'Z-Custom Dynamic Skip' at the 'Dynamic Skip' row of the corresponding filed which is supposed to be suppressed.

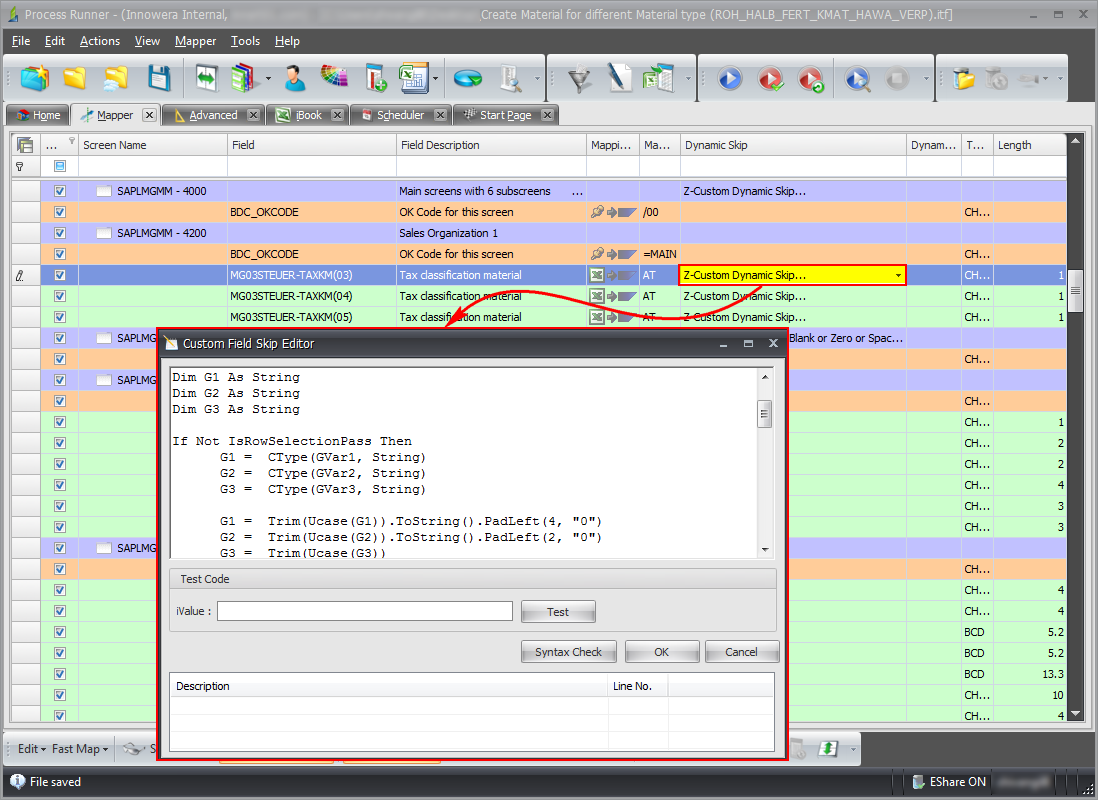

c.Write the script as per the requirement at the 'Custom Field Skip Editor' window.

d.Save and Run the Process File. |