Maintain Multiple Tax Values in Sales Organization View

Maintaining multiple tax values in sales organization is a complicated task when considered to be carried out manually. This is due to the reason that the maintenance is required based on sales organization and its distribution channel for a particular country.

The complexity and need for an automation arises when more than one tax division exist in tax organization for a particular country. It is necessary to figure out the tax liability of a particular division for a particular country within sales organization. Process Runner can automate this manual task to figure out the tax liability and update the data accordingly to SAP. This section describes how to automate and perform this task using Process Runner.

Suggested Solution:

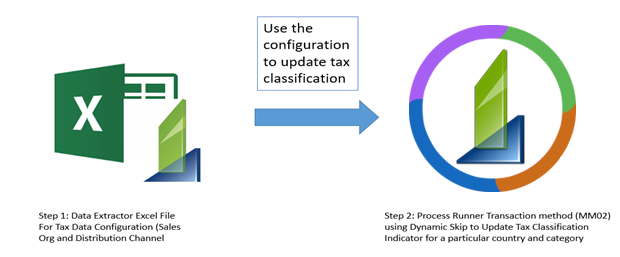

Updating multiple tax values based on Sales Organization and its distribution channel for a particular country can be automated using Process Runner technologies; Transaction, BAPI, and GUI Scripting. Expand the following sections for information about how to implement the same with corresponding Process Runner technologies.

When it is required to update the multiple tax values based on Sales organization and its distribution channel for a particular country through Transaction Technology, a Data Extractor Excel Add-In file is implemented to extract the maximum count so that the Dynamic Skips can be implemented accordingly in the Transaction Process file.

Follow these steps to extract the required data.

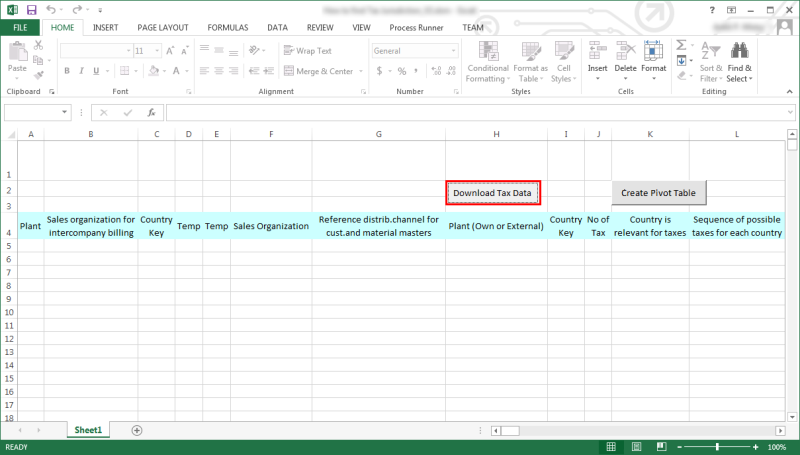

- Download and open the Excel Add-In file from here or refer to the Cloud Sample 471 How to find Tax Jurisdiction.

- Click Download Tax Data.

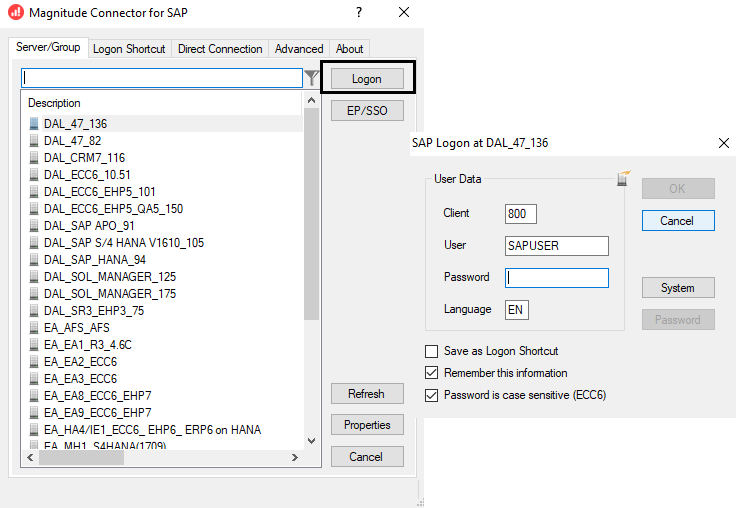

- Select the SAP Server/Group, provide valid credentials and click Logon.

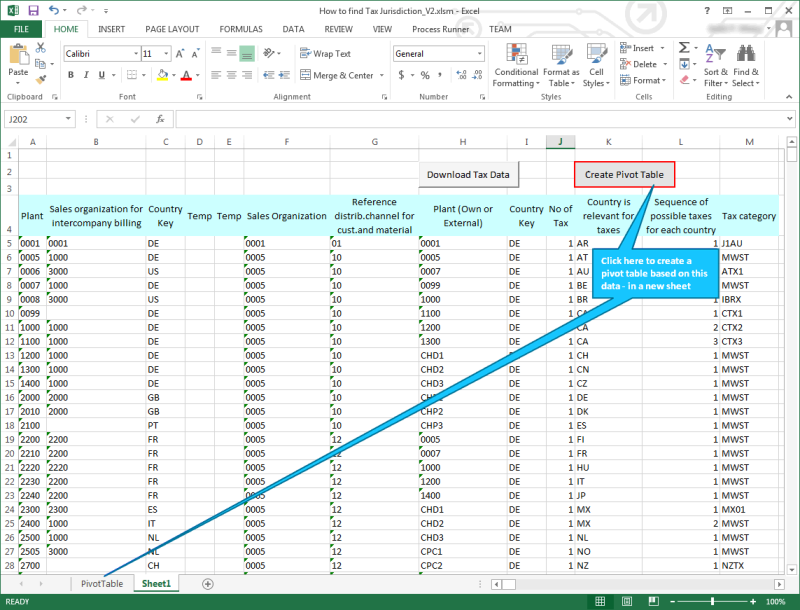

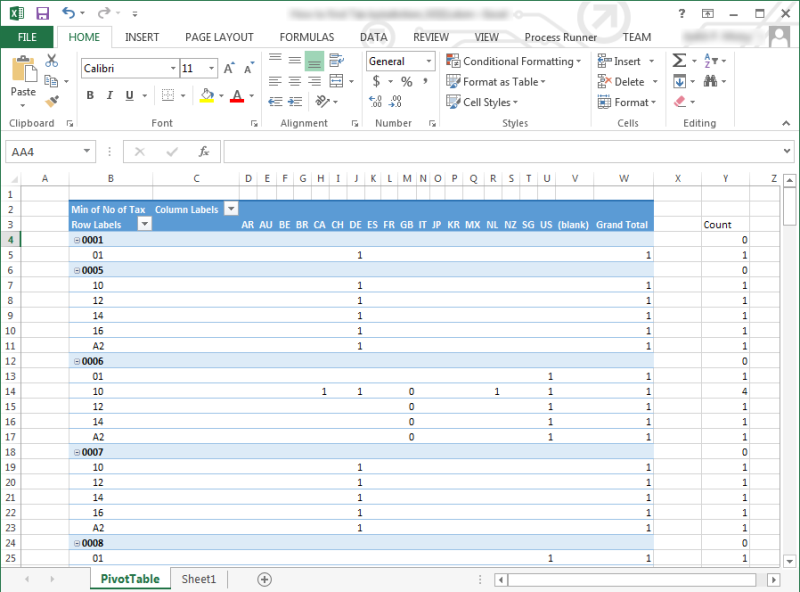

- Click Create Pivot Table to create a Pivot table based on the extracted data of your SAP System as shown in the following screenshot.

Note: Ensure that no changes are made to the Excel Add-In file

This Pivot table is generated in a new sheet as shown in the following screenshot.

Now that the Tax Count available within Distribution Channel and Sales Organization is figured out, download and modify the MM01 Process File Cloud Sample 2171 for your environment as follows:

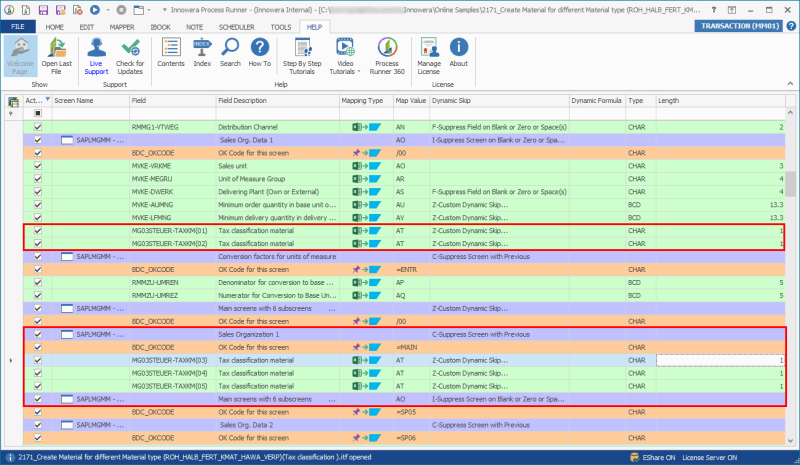

- After you download Cloud Sample 2171, open the Process file, and go to Mapper. For information about how to open Cloud samples, see Open Process File.

- Observe the maximum value at the Count column in the PivotTable sheet of the Excel Add-In file.

- From the above example of downloading tax data and creating Pivot Table, we have the maximum value of column Count as 5, according to which the Process File (Cloud Sample 2171) is created. If the maximum value of column Count is more or less than 5, then refer to the following screenshot where we are adding or removing fields. This is done manually. For information about how to add or remove fields manually in Mapper, see Manually Add Screen and Fields in Mapper .

For example, if maximum value of column Count is 1, then we have added a screen and fields as highlighted in the following screenshot.

Note: Ensure that the Field of Tax Classification Material (MG03STEUER-TAXKM) in Mapper is equal to the maximum value of the Count column of the PivotTable sheet.

According to the combination of sales organization and distribution channel, field suppression is required where tax classification is not available.

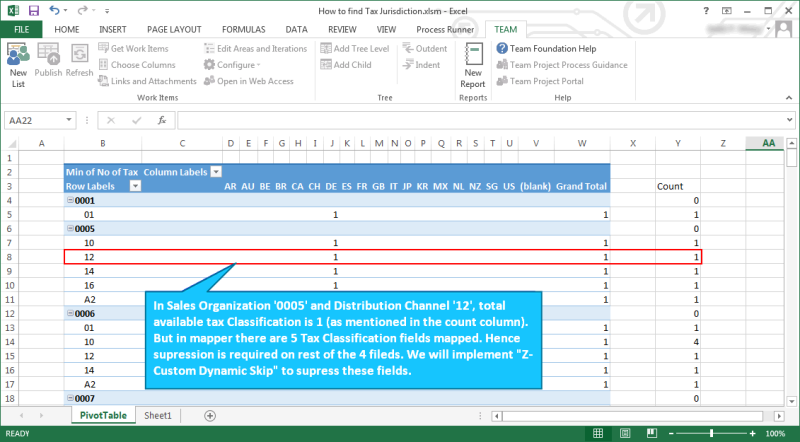

As indicated in the screenshot, the total tax available for Distribution Channel 12 in Sales Organization 0005 is 1. Hence the value in the count column is 1. But in Mapper, there are 5 tax classification fields whereas only 1 tax classification field is required.

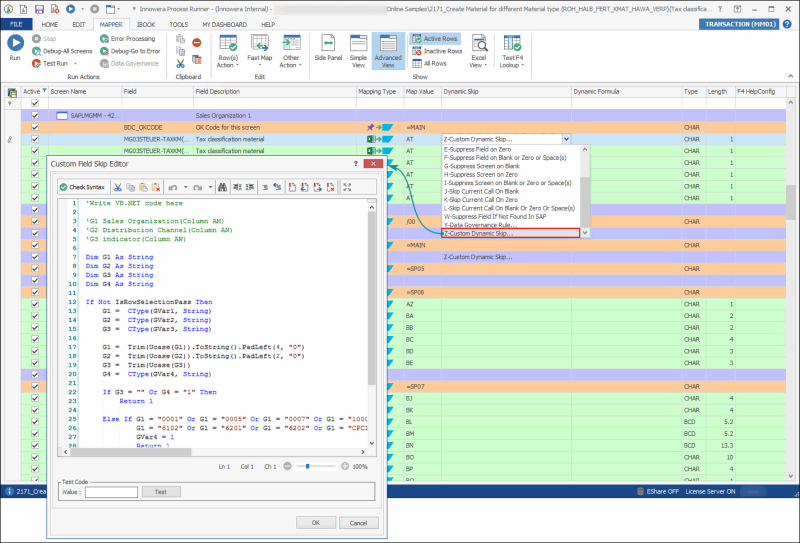

In such cases, suppression of rest of the 4 fields is required which is done using Z-Custom Dynamic Skip. Follow these steps to suppress the fields that are not required.

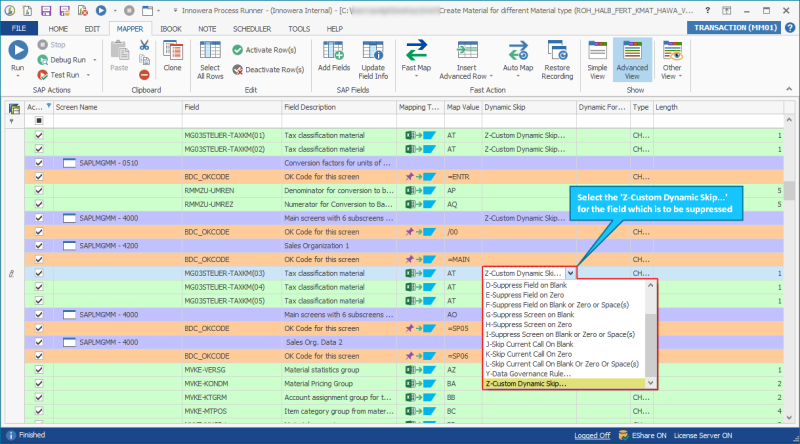

- To suppress the fields, go to Mapper in Cloud Sample 2171.

- Click and Select Z-Custom Dynamic Skip at the Dynamic Skip row of the corresponding filed which is supposed to be suppressed.

- Write the script as per the requirement at the Custom Field Skip Editor window.

-

Save and Run the Process File.

Alternatively, you can use BAPI technology of Process Runner to change or update Tax Classification in SAP. Refer to Cloud Sample 157 ‘BAPI_MATERIAL_SAVEDATA – Tax Classification’. Provide Material Number, Departure Country, Tax category, and Tax classification and click Run. This is updated accordingly in SAP

For further assistance, please create a support case on Salesforce.